Car Insurance Loss of Use Claim Malaysia

Moreover if the damaged car was your sole mode of transportation you have to book a rental car to meet your. LOSS OF USE LOU claims aka Compenssation assessed repair time CART 1.

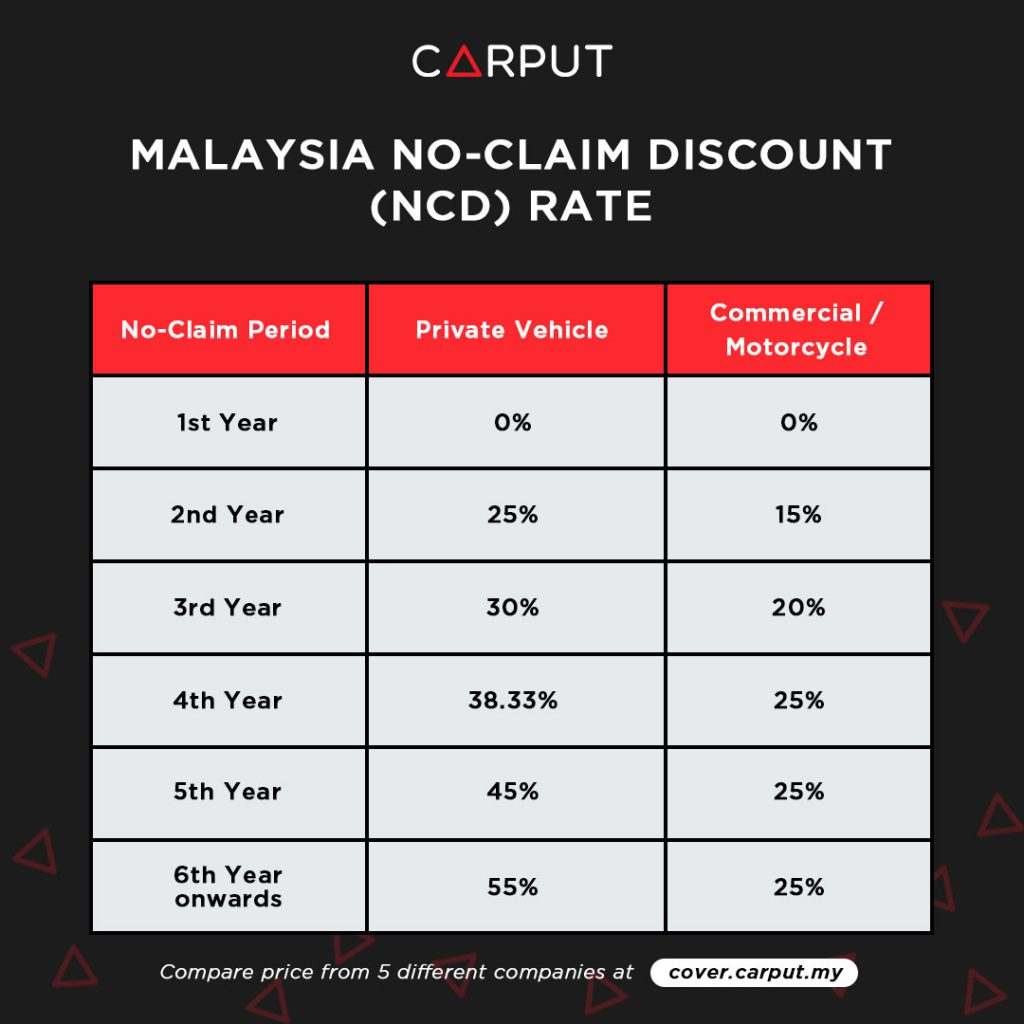

Motor Insurance No Claim Discount Ncd Rate In Malaysia Carput

Basically there are 3 types of insurance.

. Contact and inform your insurance agent or insurance company regarding the accident and seek advice on what forms or documents are required to support the claim. For example if your car insurance excess is RM200 you will have to pay the first RM200 of any claim you make. This is the most basic and common car insurance bought by car owners as it is mandatory to have this type of car insurance for every vehicle.

There are two types of insurance claims that you could make in the event of a car accident. If your car is damaged or totaled and you cannot use it for a period of time you could qualify to file a loss of use claim. This is when you make a damage claim against your insurance policy.

Date damage incurred location etc. Accident with another private car with Comprehensive policy. In the event of an accident you should call Takaful Malaysias Auto Assist Helpline number and ensure that your vehicle is sent to Takaful Malaysias Panel of Workshops or an authorized franchise repairerdealer car manufacturer service centre.

1 Own Damage claim 2 Own Damage Knock-for-Knock claim and 3 Third Party claim. The loss of use claim is essentially meant to cover the cost of a rental car or other alternative transportation that you used during the time when your car was not available. In this case after your car is repaired you would send the at fault carrier our Loss of Use valuation report and ask for compensation.

Call us immediately to notify us of the loss or damage or log in to Claims Service Portal. 75-30 X 20 900. However when making the lost of use claim she was informed that the claim was only approved for less than RM1000.

You have the right to claim for Compensation for the Actual Repair Time CART. The turnaround time from notification to authorization is 60 working days and payment is made within 7 days. Information about the incident.

Insureds IC card and driving license. A police report should be lodged within 24 hours. Before filing your claim s via our Online Claim Form make sure your details are complete.

There are three types of car insurance claims. These are the different types of car insurance claims and car insurance claims processes in Malaysia. In that year the Net Claims Incurred Ratio NCIR decreased by approximately.

I had also been asked to sign a letter claiming for loss of use of vehicle due to negligence of third party given RM4000 x 28 days RM1120. You will not be entitled to claim for an accident that results in damages below RM200. The claim ratio of the motor insurance sector in Malaysia decreased from 701 percent in 2019 to 625 percent in 2020.

Assessed Repair Time is to indicate the compensation is based on the independent loss adjusters assessment of the time required for repairs. Some workshops are even prepared to pay you loss of use at RM50 per day whilst in their workshop. At the end of the repair she received the BMW in good condition.

Below is the daily CART gauge outlined by Persatuan Insurans Am Malaysia PIAM. 1st party 3rd Party and All Riders Policy for motors. Having this insurance coverage allows car owners to be protected from having to pay the damages of another car in the event of an accident.

Hence my car was sent to the workshop for repair which took 28 days. Old cars normally use 3rd Party insurance. Whenever your car at workshop for repair u cannot use your car.

It is estimated based on the number of days to have your car repaired. Loss of use is a type of auto insurance coverage that makes payments towards car rental bills when your vehicle has been in an accident and has to be sent for repairs. We recommend that you carefully read and understand this document.

The workshop submitted my claim to a particular insurance company. Previously motorcycles normally use 3rd Party insurance too. A vehicle without insurance contravenes Section 90 1 of the Road Traffic Ordinance 87.

The reason is because the insurance company. Motor insurance or takaful claim. Normally the claim form is to be submitted with a the police report lodged by the driver b photocopy of the Identity Card c Drivers Licence d Vehicle Registration Card.

This claim applies if the damaged car was one you were leasing or owned. Fatiha Ziqra shared on her Facebook that her car was badly damaged and had to be put in a workshop for 98 days to be repaired. CART is the new terminology for loss of use approved in accordance to Bank Negara Malaysia Guideline.

Additional information about any other people vehicles or property involved. Types of car insurance claims. However when they execute the claim with third party insurer their claim for the repair cost may be 800 to 1000 more than your actual claim and the loss of use duration may be double or triple of what they have given you.

Make loss of use claim against the other persons insurer Make a Third Party Bodily Injury or Death claim. Own damage claim when you make a damage claim against your own insurance policy. But u can claim loss of use as u unable to use your car.

It is best to verify this before you need to make a claim however even if you do have to pay a deductible the insurance company usually just pulls it out of the money they will be sending you. Details and supporting documents that describe the loss or damage you are claiming for. Original MSRP 24000 rental rate 30 per day.

This is the amount of loss you have to bear before your insurance company will pay for the balance of your claim. U can only claim from third party insurance. It is an alternative to ling a Third Party Property Damage claim.

You can claim CART under TPPD claim against third party insurer for the loss of usage when your vehicle is garaged for repair. Depending on the nature of the accident the claims involved are either. It can be quite inconveniencing to have your vehicle stuck at a repair shop for a few weeks.

Third-party fire and theft coverage. The downside to this is that you may lose your no-claim discount NCD. Loss of use or CART.

Report a loss or damage incident to relevant authorities such as Police etc. If you have a 500 deductible and you are getting 25000 for loss of use you will get 24500 which is minus the deductible. Which means that the TP insurance company will compensate you for the loss of use of your car.

On completion of repair I was instructed collect my car. When a person suffers the loss of use of their vehicle for any period of time they have the ability to be compensated for a rental car public transportation andor any other reasonable transportation expenses incurred as a result of the loss of use of their vehicle andor transportation means. For case no1 above after u make claim from your own insurance under ODKFK u have to claim.

Typical reasonable transportation means are busses taxis Ubers etc.

95 Reference Of Axa Auto Insurance Malaysia Insurance Car Insurance Insurance Near Me

No comments for "Car Insurance Loss of Use Claim Malaysia"

Post a Comment